30+ mortgage points tax deduction

File Online or In-Person Today. With a 15-year loan you deduct one-fifteenth.

Tpo Marketing Workflow Tax Service Products Mwf Shifts Wholesale Gears Reali Gone

Start Today to File Your Return with HR Block.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Mortgage points for tax deduction.

Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. If the amount you borrow to buy your home exceeds 750000 million. Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan.

Web Mortgage points. Mortgage discount points are. I took the standard deduction that year and did not use.

So I pain some points 05 to be exact when I bought my home on Nov 2021. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Ad Learn How Simple Filing Taxes Can Be.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Ad 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Homeowners who bought houses before.

Homeowners had a reprieve last year when the. Discover How HR Block Makes It Easier to File Your Way. However higher limitations 1 million 500000 if married.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Most homeowners can deduct all of their mortgage interest. If you bought a home and paid points then you can still deduct those from your taxes.

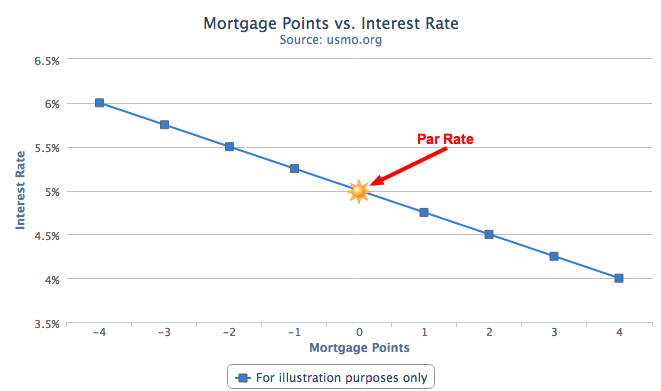

Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate.

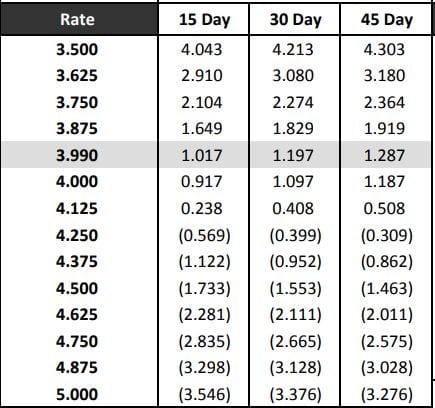

Web With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year. If you can deduct. Learn More At AARP.

Web For example if you pay 3000 in points to obtain a lower interest rate on your mortgage you can increase your mortgage interest deduction by 3000 in the. Web Here is an example of how discount points can reduce costs on a 400000 30-year fixed-rate mortgage with 20 percent down.

Home Mortgage Loan Interest Payments Points Deduction

Should You Pay Points To Get A Lower Mortgage Rate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Media Releases Pimco Prime Real Estate

Understanding Mortgage Points U S Mortgage Calculator

Are Mortgage Points Tax Deductible Pillar Mortgage Llc

Social Security Early Retirement 2022 Know Your Bend Points Physician On Fire

Va Loans Explained Guide To Va Loans Direct Mortgage Loan

Discount Points Calculator How To Calculate Mortgage Points

American Economic Association

Wfc2022

Should You Lock Your Mortgage Rate Today Forbes Advisor

Updated Lending Companies On Mintos Report Their 2020 Financial Results

![]()

5 Factors That Affect Your Mortgage Application Homewise

Expired Brex 110k Transferable Points Without A Credit Inquiry For Business Owners

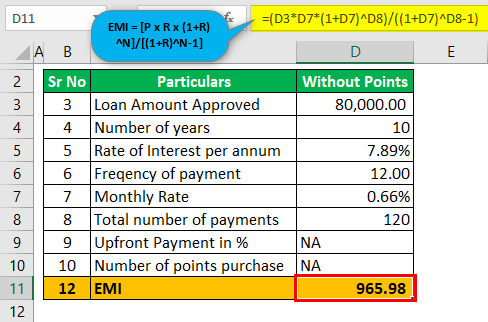

Mortgage Points Calculator Calculate Emi With Without Points

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep